The 8-Minute Rule for Estate Planning Attorney

Estate Planning Attorney Fundamentals Explained

Table of ContentsNot known Incorrect Statements About Estate Planning Attorney Not known Facts About Estate Planning AttorneyExamine This Report about Estate Planning AttorneyThe Buzz on Estate Planning Attorney

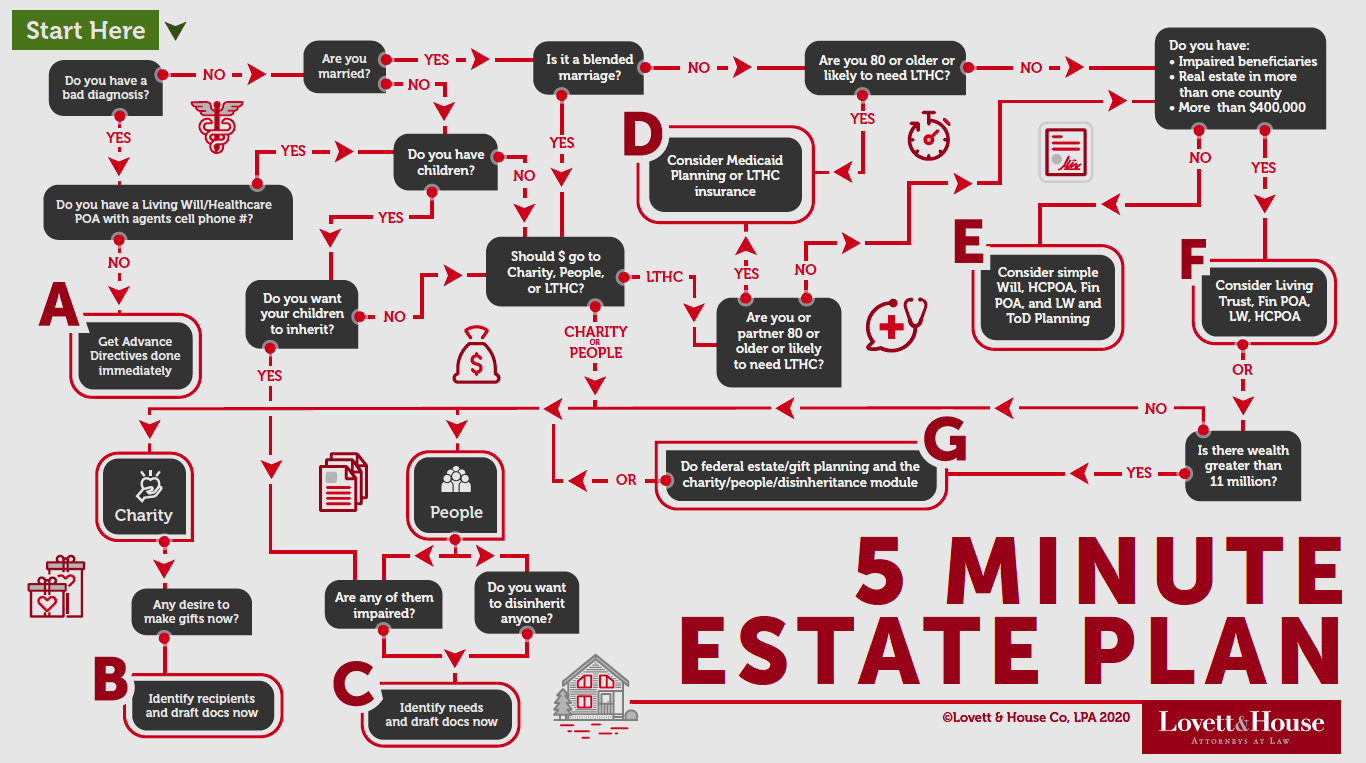

Estate planning is an activity strategy you can make use of to identify what takes place to your properties and obligations while you live and after you pass away. A will, on the other hand, is a lawful document that describes exactly how properties are dispersed, that deals with kids and animals, and any type of various other desires after you pass away.

The executor likewise needs to settle any kind of taxes and debt owed by the deceased from the estate. Lenders usually have a restricted amount of time from the date they were notified of the testator's fatality to make insurance claims versus the estate for money owed to them. Insurance claims that are denied by the executor can be brought to justice where a probate judge will have the last say regarding whether or not the case is valid.

The Single Strategy To Use For Estate Planning Attorney

After the stock of the estate has been taken, the value of properties computed, and tax obligations and debt paid off, the executor will certainly after that look for consent from the court to disperse whatever is left of the estate to the recipients. Any type of inheritance tax that are pending will come due within nine months of the date of death.

Each private areas their assets in the count on and names somebody aside from their partner as the recipient. A-B counts on have ended up being much less prominent as the inheritance tax exception functions well for the majority of estates. Grandparents might Recommended Site move properties to an entity, such as a 529 strategy, to support grandchildrens' education and learning.

The Best Guide To Estate Planning Attorney

Estate coordinators can work with the benefactor in order to minimize gross income as an outcome of those contributions or create methods that make best use of the result of those contributions. This is an additional method that can be utilized to restrict fatality taxes. It entails a private securing the current worth, and click for more info therefore tax obligation, of their residential or commercial property, while attributing the worth of future growth of that resources to another person. This method includes freezing the value of an asset at its value on the day of transfer. Appropriately, the amount of prospective capital gain at fatality is additionally frozen, permitting the estate planner to approximate their possible tax responsibility upon death and much better plan for the repayment of income tax obligations.

If sufficient insurance policy proceeds are readily available and the policies are effectively structured, any earnings tax obligation on the deemed personalities of properties following the fatality of a person can be paid without resorting to the sale of possessions. Profits from life insurance that are gotten by the beneficiaries upon the death of the guaranteed are generally income tax-free.

There are specific records you'll require as component of the estate planning process. Some of the most common ones consist of wills, powers of attorney (POAs), guardianship designations, and living wills.

There is a myth that estate planning is only for high-net-worth individuals. Yet that's not true. As a matter of fact, estate planning is a tool that everyone can utilize. Estate planning makes it simpler for individuals to identify their desires before and after they die. Unlike what most people believe, it prolongs past what to do with possessions and obligations.

The Single Strategy To Use For Estate Planning Attorney

You ought to begin planning for your estate as quickly as you have any kind of measurable property base. It's an ongoing procedure: as life progresses, your estate strategy should move to match your circumstances, in line with your new objectives.

Estate preparation is frequently believed of as a device for the well-off. Estate preparation is likewise a great way for you to lay out plans for the care of your small kids and pet dogs and to describe your desires for your funeral service and favorite charities.

Applications have to be. Eligible applicants that pass the exam will certainly be officially licensed in August. If you're eligible to rest for the exam from a previous application, you may submit the short application. According to the policies, no qualification will last for a period much longer than five years. Figure out when your recertification application is due.